Renewable Term Assurance Definition

A life insurance policy that provides coverage only for a certain period of time but which may be renewed at the end of that period. This option allows you to extend your policy once it has come to an end instead of arranging new cover.

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

Your policy will come with a renewal table showing you what your premiums would be if you decided to renew.

Renewable term assurance definition. 10 Year Term Renewal Rate Schedule Sample Policy Year. It provides a simple and easy way of securing cover should you outlive your original policy. Premiums increase with each renewal due to your attained age.

This means that you can renew your policy to last beyond the term period that you purchased. Below is a sample chart of what your renewal schedule could look like. ART is similar to level term insurance with one key difference.

Annual renewable term ART life insurance is a type of short-term policy that provides coverage for one year with the option of renewing the policy annually. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term.

Years 1 - 10. A yearly renewable term is a one-year term life insurance policy. If you pass away during this time your beneficiary receives money from the life insurance company.

Renewable Term Life Insurance. However it can be renewed at the end of that period. The new premium will be based upon your age at the time you take up the option.

To cover an interest-only mortgage or to provide a lump sum for your family. Renewable energy is energy that is collected from renewable resources that are naturally replenished on a human timescaleIt includes sources such as sunlight wind rain tides waves and geothermal heat. Annually renewable term policies are best for short-term life insurance needs because premiums eventually become more expensive than those for a comparable term life insurance policy.

Cons of renewable term life insurance. There is generally a set age limit as to when you can no longer renew the term. Renewable term life insurance is a life insurance policy that provides coverage only for a certain period of time.

Renewable and Convertible Term Assurance are sometimes combined in the same policy. Renewable term assurance is level term assurance but with the flexibility to renew the plan regardless of your state of health at the point of renewal. Term Assurance where the value of the Sum Assured is linked to increases in an index - usually the Retail Prices Index RPI.

Renewable term life insurance functions the same way but terms last only one year and the policy must be renewed each year at a higher premium. The premium for this kind of policy will usually increase at a. In most cases the price of the premium for the extension will increase.

If your term life insurance is an annual renewable policy you can renew your coverage each year without filling out a new application or passing a physical exam. The family home and small business graphics move within the shield. Is not meant to stay in force forever.

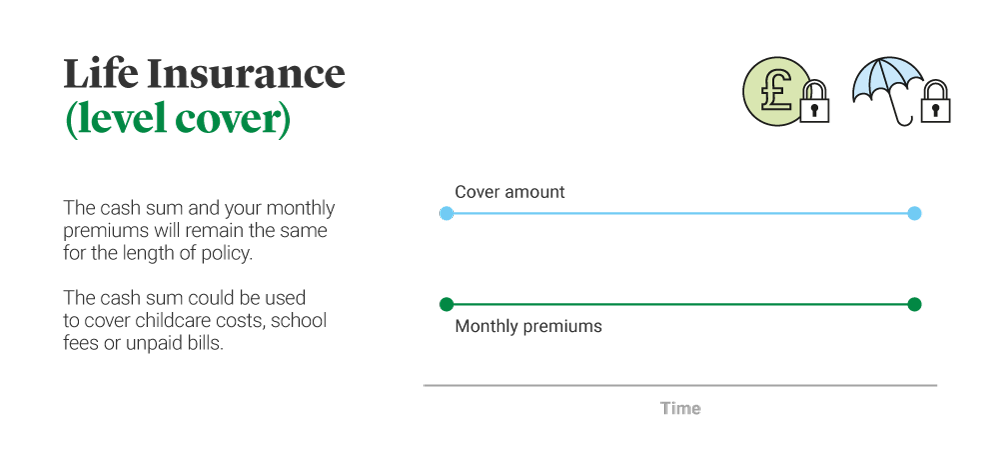

Level Term Assurance can be used if you need a specified amount of cover for a certain length of time eg. Eg A 10 year term policy may be renewable to age 80 with the premium going up each year after the original 10 year period ends. This type of policy gives policyholders a quote for the year the coverage is bought.

A term life insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if. A shield graphic enters frame. A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy.

At the 10-year anniversary you will be given the option to renew the plan free. Renewable term assurance also known as renewable life insurance is an optional benefit that can be added to some life insurance policies. Term insurance by definition.

Convertible Insurance Definition. In short you take out your term assurance for a set term for example 10 years but include the renewable option. For more details on this type of life insurance cover visit us.

Renewable energy stands in contrast to fossil fuels which are being used far more quickly than they are being replenishedAlthough most renewable energy sources are sustainable some are not. The best definition of Convertible Term Life Insurance is that despite it being similar to term insurance - with convertible term life insurance you have the option to convert the policy into a new policy for a longer term. Canada Life My Term life insurance provides protection tailored to your needs and what you can afford.

A form field appears to show a coverage amount of 500000. However the premium or the amount you pay for the policy isnt fixed and goes up each time you renew. Renewable and convertible term life insurance policies have features that allow you to do the following.

In other words it is a term life insurance policy that allows the policyholder to renew the policy after the policy has matured. Term life insurance guarantees a death benefit to your beneficiary for a set time such as 10 20 or 30 years. Changes in your health can result in paying more for the same amount of coverage.

Annual renewable term insurance. This type of Term Assurance gives you the option at the end of the original term to extend the policy for a further term without the need for Medical Underwriting. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

You may not be allowed to renew the policy for more than one additional term. Life insurance companies offer different lengths of policy coverage usually 5 years 10 years 15 years 20 years and then 25 30 or possibly 40 year coverage periods depending upon the. Whereas level term charges the same premium amount for the full length of the term period ART premiums will increase over.

Your policy may cover you your partner or both of you depending on the cover.

Best Term Insurance In The Philippines Ultimate Guide In Getting Insured

Annuity Vs Life Insurance Similar Contracts Different Goals

:max_bytes(150000):strip_icc()/lifeinsurance_92028809-ff7e776ca19c409480e1a4d6daf27379.jpg)

Conditionally Renewable Policy Definition

:max_bytes(150000):strip_icc()/agent_121198814-5bfc386846e0fb00265f75a0.jpg)

Annual Renewable Term Art Insurance Definition

:max_bytes(150000):strip_icc()/GettyImages-1083840976-a828869589624ed28316b9352c7aff11.jpg)

Annual Renewable Term Art Insurance Definition

:max_bytes(150000):strip_icc()/guaranteed_vs_non_guaranteed_permanent_life_insurance_policies-5bfc375b46e0fb0083c3769b.jpg)

Annual Renewable Term Art Insurance Definition

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Life Insurance Powerpoint Slides

Types Of Life Insurance Legal General

Life Insurance Powerpoint Slides

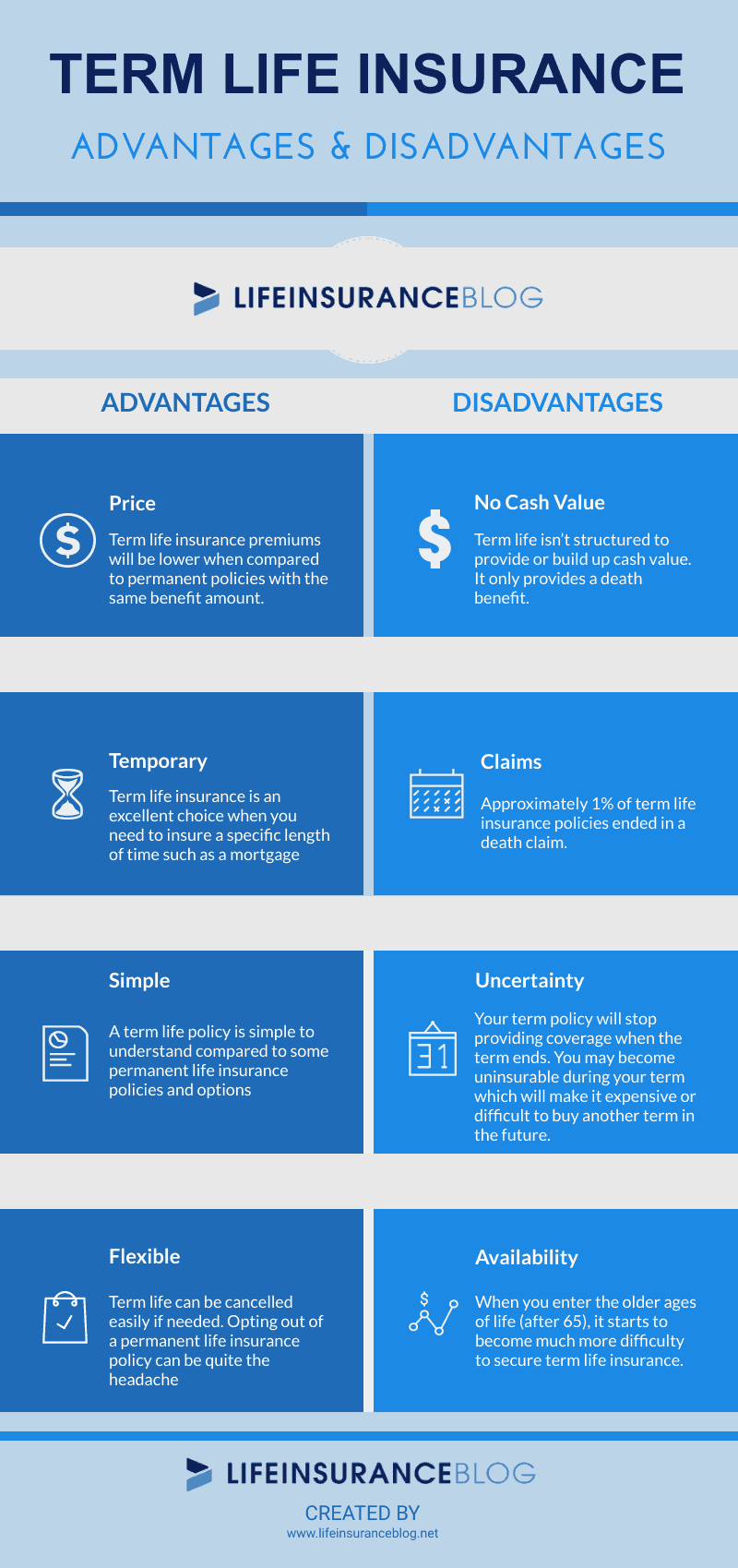

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Voluntary Life Insurance Quickquote

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Learn The Lingo What Does Guaranteed Renewable Mean

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

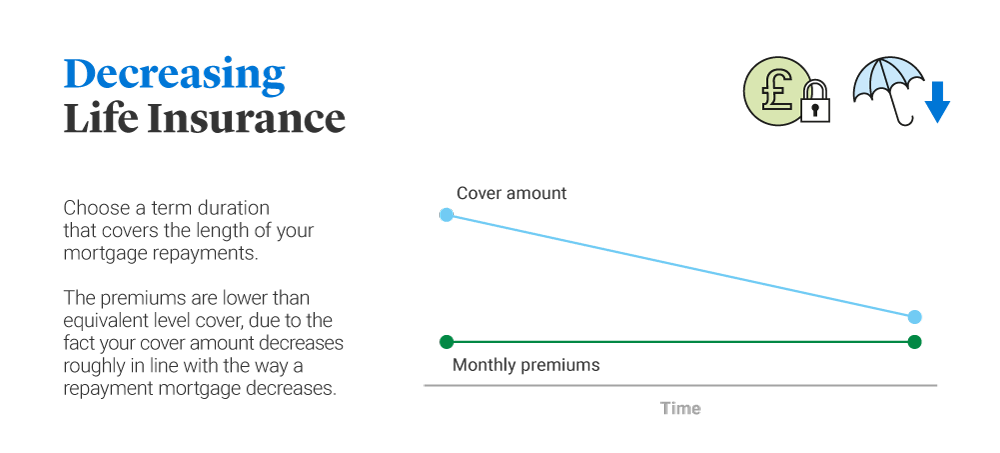

Decreasing Term Insurance Definition

Types Of Life Insurance Legal General

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

Insurance Long Duration Contracts Insurance Analyzer Info

Posting Komentar untuk "Renewable Term Assurance Definition"