Advantages Of Whole Life Assurance

These are the main perks of taking out a whole life insurance policy. Whole life insurance generally offers more expensive initial premiums than the short-term term life insurance even though the amount of the death benefit may be exactly the same in both policies.

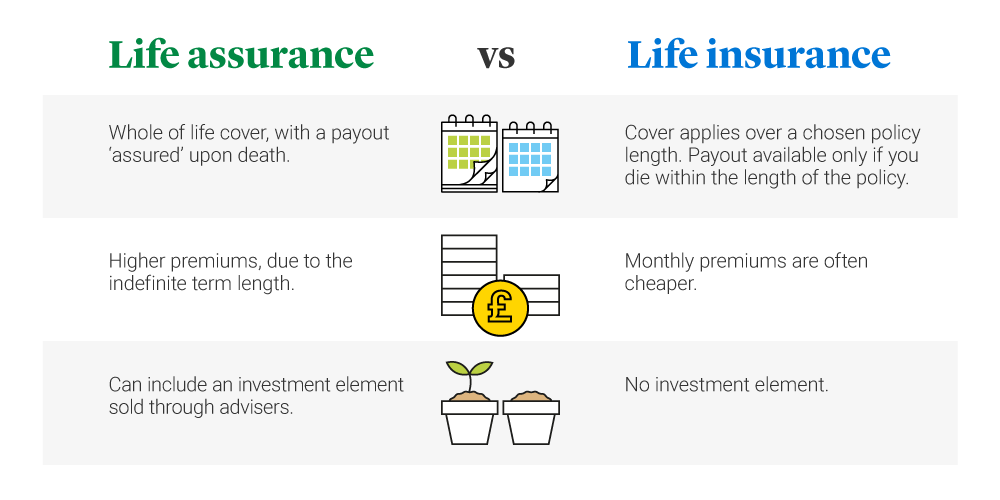

Life Assurance Vs Life Insurance Legal General

Its sometimes called life assurance.

Advantages of whole life assurance. As a life insurance policy it represents a contract between the insured and insurer that as long. One of the coolest advantages of whole life insurance is that you can do more with your other assets. It provides lifelong protection.

This is as opposed to term life insurance which will only pay out should you die within a certain set period of time. Unlike term life whole life insurance lasts a. A portion of every premium payment you make is added to your policys cash value which accumulates slower in the early years of the policy.

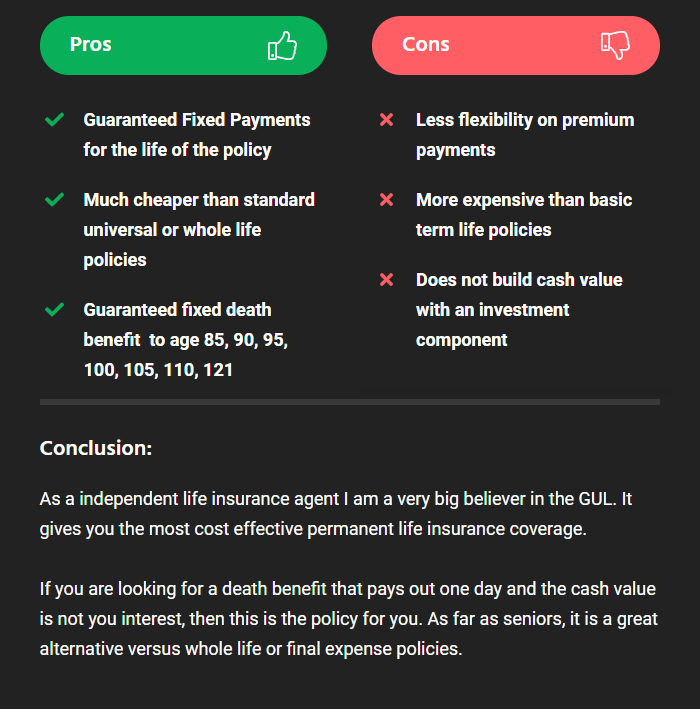

Whole life insurance does that and also becomes a cash asset over time. Whole Life Insurance offers pros and cons but for most Americans term life insurance is a better option. Whole life insurance is a policy designed to pay out a lump sum when you die whenever that might be.

Particularly if Youre young and healthy or you have enough savings to purchase a cash value whole life insurance policy with a paid. This is in contrast to term life insurance which only guarantees that there will be a payout should you die within the specified term of the policy. Here at IE we spend a lot of time talking about some of the key advantages of purchasing whole life insurance policies.

To use as a gift from you. Ad His Course Will Give You An In-Depth Look At Life Insurance And Its Different Types. Advantages of whole life insurance.

Whole life insurance builds cash value. Thats because it becomes the token permission. Life insurance is a great way to protect your family not so much as an investment.

It is set up this way specifically as IHT is only usually due on the second death assuming that each spouse leaves the majority of their wealth to the other spouse. Its also referred to as whole of life insurance since it lasts for as long as you do. Alison Free Learning Providing Opportunities To People Anywhere In The World Since 2007.

The benefits of writing life insurance in trust. Alison Free Learning Providing Opportunities To People Anywhere In The World Since 2007. Whole of life assurance is guaranteed to last forever.

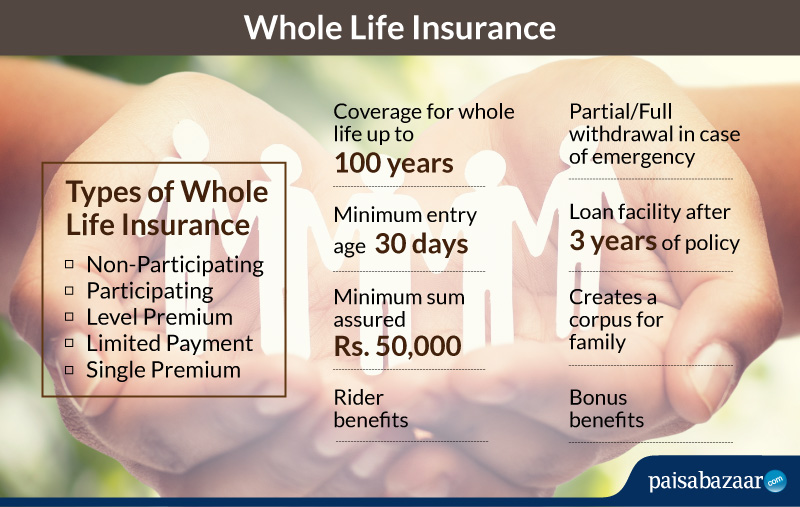

Whole of life insurance or life assurance policies are designed to pay out in the event of your death whenever this may be. Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. Your loved ones can use the money from the policy however they need.

Here are some of the ways you can benefit from a life insurance trust. Whole of Life assurance will generally pay out on the second death of a husband and wife. Benefits of Whole of Life Assurance Plan.

But as we stated before the cost of the premium stays the same over time so its really an advantage to buy whole life insurance in the long run. There are various benefits to whole of life cover that well go through over the course of this guide. Its not a replacement for you but its a help to stop those who are grieving having to deal with the financial impact of your death as well as the significant emotional one.

You can get life insurance to help pay for any IHT due on your estate when you pass away. Whole life insurance policies serve an investment with actual cash value. Ad His Course Will Give You An In-Depth Look At Life Insurance And Its Different Types.

Whole-of-life insurance is a type of life insurance policy which ensures that no matter when you die your loved ones will receive a lump sum payout from your insurer. The main benefit of whole life insurance sometimes called cash value life insurance is to combine life insurance with an investment program that you dont have to do much about. Whole life isnt just an all-star player its like a magic sauce that elevates the rest of the team as well.

But their premiums are significantly higher than term life so you may not find that its right for your own budget. But it might be years before youll be able to make the most of its living benefits. Life insurance is available in various types the most common of which are term assurance and mortgage protection these are both types of term assurance.

Whole of Life for IHT Planning in practice. Control over your assets if you dont have a trust your money might be used to pay off outstanding debts. There are many reasons why putting life insurance in trust is a popular option.

Answer 1 of 20. If you keep up the regular monthly payments you know that the money is there waiting. In other words you send the premiums to the life insurance company they use part of those premi.

But its benefits may be worth it later in life when term life policies become much more pricey. Cash value is one of the key living benefits of whole life insurance. Exclusion in LIC Whole Life Assurance - with Profits- If the Life Insured under the Policy whether medically sane or insane commits suicide within one year of the date of issuance of the Policy the Policy shall be void and the Company will only be liable.

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

Whole Life Insurance Check Compare Whole Life Insurance Online

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Benefits Of Life Insurance Life Insurance Facts Life And Health Insurance Benefits Of Life Insurance

Benefits Of Whole Life Insurance Life Insurance Quotes Life Insurance For Seniors Universal Life Insurance

Benefits Of Whole Life Insurance Guardian

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Annuity Vs Life Insurance Similar Contracts Different Goals

Whole Life Insurance How It Works

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Getting To Know Permanent Whole Life Insurance Sproutt

How Does Whole Life Insurance Work Costs Types Faqs

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

Term Life Vs Whole Life Insurance Instant Cost Calculator

Whole Life Insurance Definition And Meaning Market Business News

Whole Life Insurance Definition And Meaning Market Business News

Types Of Whole Life Insurance Life Insurance For Seniors Family Life Insurance Life Insurance Quotes

Posting Komentar untuk "Advantages Of Whole Life Assurance"