Partnership Assurance Ipo

PB Fintech the holding company for online insurance distributor Policybazaar and loan comparison portal Paisabazaar has fixed. Or choose from the following categories.

The Biotech Ipo Boom Of 2020 And 2021 Bdo Insights

Partnership Assurance completes IPO.

Partnership assurance ipo. Acquisitions and alliances AGM and other meetings Board changes Capital structure. 27 2021 PRNewswire -- For years Pinnacol Assurance has urged Coloradans to walk like a penguin to avoid slipping tripping or. Partnership Assurance has floated on the London Stock Exchange and hopes to be added to the FTSE 250 later this year.

Partnership Assurance PAL started trading on June 7th and is currently valued at over 18bn which is an trailing IFRS profit EBIT multiple of over 15. Friday morning brought good news for the European IPO market with strong aftermarket performance for Partnership Assurance and an early coverage message for. The actuarial team worked alongside corporate finance and audit to provide a truly combined service to Partnership.

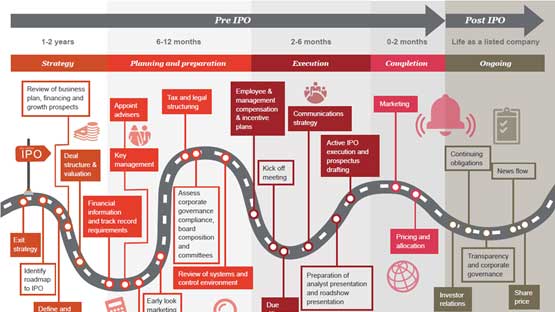

GQG Partners priced its IPO at 2 a share which was the bottom of the 2 to 220 a share price range. After delaying its IPO late last month Ensemble Health Partners is now withdrawing it altogether. Our IPO Centre makes it easier for you to understand what you need to know and what you need to do to complete an IPO.

Cinven Eyes Rich Returns from Partnership Assurance IPO The UK private equity firm could be in line for a substantial return on its original investment in life insurer Partnership Assurance. Policybazaars Rs 5710cr IPO gives co valuation of 6bn. Cinven Partners LLP a London-based private-equity firm said it will reap seven times its investment in UK.

Annuity provider Partnership Assurance Group Plcs initial public offering. Partnership Assurance was until this week one of most successful life insurance companies on the London stock market thanks to its focus on providing annuities to people who are ill or close to. Leeds-based Panmure Gordon Co the independent institutional stockbroker and investment bank has acted as co-lead manager on the 154bn initial public offering IPO of Partnership Assurance Londons largest float of the year to-date.

7 Jun 2013 South East Deals. Just Retirement Group plc. Partnership IPO Deloitte played a significant role in helping Partnership Assurance complete its debut on the London Stock Exchange including acting as reporting accountants to the IPO.

Partnership Assurance Group has set its offer price at 385p per share meaning its implied market capitalisation for its initial public offering IPO is 15bn. It is expected the group will be eligible for inclusion in the FTSE 250 index from September and conditional dealings on the London Stock Exchange are due to start today at 8am. The business based at Redhill in Surrey set an initial offer price of 385p per ordinary share giving an implied market capitalisation of 15bn.

Tuesday May 14 2013 714 pm. EIN Presswire A press release service with dozens of industry channels to choose from. Your press releases will reach hundreds of news publications partner newswire services journalists social media users.

Mere months after Saks Fifth Avenues e-commerce arm struck out on its own at a 2B valuation the company is reportedly considering an IPO worth 6B. The companys lead managers UBS and Goldman Sachs. An umbrella partnership C corporation Up-C structure allows a pass-through entity the best of both worlds achieving preferential tax treatment for both the pre-IPO investors and the new publicly-traded corporation while also enjoying access to the capital markets.

GQG Partners founder Rajiv Jain. Life insurer Partnership Assurance floated successfully in London valued at over 18bn presenting its private equity owners with a return of more than seven times their original investment. Chief Executive Steven Groves stake worth 48 mln pounds.

Panmure Gordon advises on 154bn Partnership Assurance IPO. The share price of annuity provider Partnership Assurance Group leapt this morning 7 June on the London Stock Exchange as it became the latest UK insurance firm to IPO. DirectorPDMR shareholding Disposals Holding s in company Results.

We can help you evaluate the pros and cons of an IPO navigate the listing process and prepare your business for life as a public company regardless of the market you choose to list on. Partnership Assurance IPO News Service from EIN News. Partnership Assurance made a strong stock market debut on Friday after selling shares at 385p in its initial public offering near the top end of its expectations.

GQG Partners said it would sell 5935 million securities at 2 to 220 each for its IPO to raise 1187 billion to 1306 billion. Over the past few decades the popularity of Up-C structures as a means to.

Ipo Services Audit Assurance Pwc

The Complete Course On Ipo Training Course Glomacs Online

Up C Structure Services Deloitte Us

Partnership Assurance Group Crunchbase Company Profile Funding

The Biotech Ipo Boom Of 2020 And 2021 Bdo Insights

Ipo Services Audit Assurance Pwc

Korea S Flitto Raises Usd 23m In Ipo Slator

Ipo Services Audit Assurance Pwc

Up C Structure Services Deloitte Us

Ipo Services Audit Assurance Pwc

Ipo Services Audit Assurance Pwc

Ipo Services Audit Assurance Pwc

Partnership Assurance Group Crunchbase Company Profile Funding

Ipo Services Audit Assurance Pwc

Ipo Services Audit Assurance Pwc

Posting Komentar untuk "Partnership Assurance Ipo"