Lic Term Assurance Plan

854 UIN - 512N333V01 Policy Document740KB Date of Launch. On the off chance that the existence guaranteed meets with a less than ideal death when covered.

Lic E Term Plan Term Insurance In Hindi Youtube

This is a without profit term insurance plan which provides for insurance coverage for a fixed term in lieu of payment of relatively low premium.

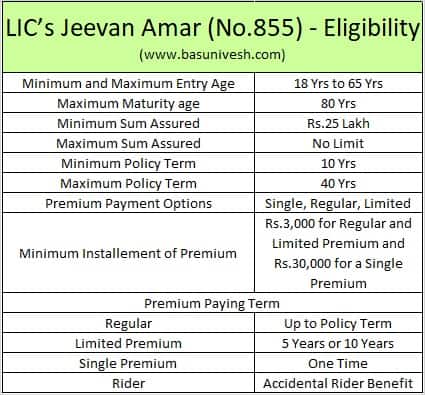

Lic term assurance plan. These policies provide the policy buyer a risk cover against death for a period of time as defined in the policy tenure. Buy LIC term insurance plans from LIC agents and brokers banks etc. For people seeking insurance more than 25 lakhs Jeevan Amar is the plan.

854 LICs newly launched tech-term plan is a non-linked non-participating online pure risk premium plan which provides large cover at affordable premiums also it provides financial protection to the insureds family in case of unfortunate death of the policyholder during the policy term. Available with two benefit structures the level sum assured and increasing sum assured. Anmol jeevan is for people who are looking at term insurance for minimum of 6 lakhs and a maximum of 25 lakhs.

The LIC term plan allows insurance buyers to buy a high amount of coverage levels at very low premiums. LIC Term Insurance Plan. The LIC term plan calculator can be used online easily in a simple and hassle-free way.

If you are not sure about the plan and its features then you can easily compare them online. Questions regarding term plan. This is pure online term insurance planTerm plans come with lower premiums compared to endowment or money back insurance plans.

The plan doesnt provide any maturity value if the person survives till the end of his plan. LIC e-Term plan is a pure insurance policy which means that it offers Death Benefit only ie. Key Features of the Plan.

Learn about LIC Term Plans with Maturity Benefits. 512N312V02 A non-linked with-profit whole life assurance plan LICs Jeevan Umang plan offers a combination of income and protection to your family. LIC term plans can secure your family against any loss of income that the family might face in the absence of the policyholder.

Under this term insurance plan the death benefit is offered to the policys beneficiary in case of the demise of the life insured during the policy term. There are various plans which are cheap and they provide high coverage. Each individuals insurance needs and requirements are different from that of the others.

LICs Tech Term Plan No. All the LIC Term Insurance Plans offers security to all the individuals at low cost. The purpose of the LIC term plans is to meet a persons need for insurance coverage without breaking his or her budgetCheck out details about LIC Term Plan with Maturity Benefit Calculator.

The Life Insurance Corporation of India LIC offers an extensive range of insurance products to cater to the various requirements of insurance buyers. PURE TERM ASSURANCE PLAN NO. By making regular payment of premium you will.

512N333V01 A Non-linked Non-participating Pure Risk Premium Plan LICs Tech-Term is a Non-Linked Non-participating Online Pure Risk Premium Plan which provides financial protection to the insureds family in case of hisher unfortunate death during the policy term. Does LIC have any term plan. These policies give the policy purchaser a risk cover against death for a period of time as characterized in the policy residency.

LIC e-term Plan Details. LICs Jeevan Umang UIN. LIC Tech Term Plan is a non-linked and non-participating online pure risk premium plan that offers financial protection to families of policyholders in case of their unfortunate death within the policy period.

LIC Term Plan Premium Calculator is an online tool that is specifically designed to help customers estimate the approximate premium rate of the LIC Term Insurance Policy. To be a member of this plan you should be an Indian citizen with at least 18 years of age and a maximum of 60 years. What is Jeevan Amar term plan.

After the new regulations passed by IRDA LIC provides a rate of around Rs. This is a regular non-practicing online term assurance plan that provides financial protection to your family. As per ones requirement and choice the customers can choose from different LIC plans ranging from pure protection to whole life endowment and money.

If the policyholder survives through the LIC e-Term plan tenure the beneficiary shall not. LIC Tech Term Plan in Hindi LIC Tech Term Plan - Table No. All these plans provide numerous benefits if the policyholder dies during hisher tenure plan.

People favor these plans even though they do not offer any maturity. LIC Tech Term Plan. LICs Tech-Term is a Non-Linked Without Profit Pure Protection Online Term Assurance Policy which provides financial protection to the insureds family in case of hisher unfortunate demise.

To calculate the premium rate of the policy one just needs to enter the relevant. LIC Term insurance or term assurance policies are one of the most basic types of insurance plans. LIC Term insurance or term confirmation policies are a standout amongst the most essential kinds of insurance plans.

1 Pure Term Plan. As individuals it is inherent to differ. 2 Online Term Insurance Plan.

To claim a death benefit you need to follow a strict process which requires careful documentation and proofs. The plan covers your family from the risk of death for the limited period called term. LIC Term Life Insurance Claim Process.

Term insurance takes care of the family in such unfortunate times. Though a very long task the process. LIC policies offer a one-stop solution for all the insurance needs of the buyers.

Offline term insurance plans comes with high premium as one need to depend on LIC agents and they would get a commission on thatHowever with online term insurance plans there is no dependency. We all work hard to enhance our familys financial status lifestyle to fund our childrens education and to secure a respectable retirement for ourselves. Benefits Offered by LIC Amulya Jeevan.

If the life assured meets with an untimely death when covered under a term insurance plan hisher. This plan will be available through. LIC Amulya Jeevan is a comprehensive term insurance plan which comes with an additional bonus facility.

LICs Insurance Plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. In India you will get many insurance companies that deal with term insurance plans with a cover of Rs 1 crore but LIC refers to be the best out of all. The payment of the pre-determined sum assured to the beneficiary on the policyholders death.

Yes LIC has two term plans Anmol Jeevan 2 822 and Jeevan Amar 855. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on death of.

Lic Term Insurance Compare Buy Renew Lic Term Plan Online

Lic New Term Insurance Plan Jeevan Amar

Lic Tech Term Plan No 854 Details Lic Term Insurance 2021 Policyx Youtube

Lic Tech Term Plan Details Premium Benefits Features

Lic Jeevan Amar Vs Lic Tech Term How These Two Term Insurance Plans Compare

Best Term Insurance Plans In India I Top Term Plans

Lic Tech Term Plan Lic Online Term Insurance Plan Moneymanch

Lic Term Insurance Plans 2020 Features And Benefits Basunivesh

Lic Jeevan Amar Plan No 855 Lic S New Term Plan Youtube

Amulya Jeevan Policy Details Lic Term Insurance Plan Hindi Policybazaar Blog Youtube

Lic Jeevan Amar Vs Lic Tech Term How These Two Term Insurance Plans Compare

Best Lic Term Insurance Plans Which Plan Is Suitable To You

Lic Term Insurance 1 Crore Best 1 Crore Term Plan Wishpolicy

Lic S Jeevan Amar No 855 Offline Term Life Insurance Review Basunivesh

Lic Jeevan Amar Plan Lic Offline Term Insurance Plan Moneymanch

Lic Tech Term Table 854 Lic Online Term Plan Review

Lic E Term Plan No 825 Review Features Benefits Life Insurance Full Detail Youtube

Lic Term Insurance Home Facebook

Lic Eterm Online Term Insurance Plan Review

Posting Komentar untuk "Lic Term Assurance Plan"