New India Assurance Solvency Ratio

About New India Health Insurance. In the public sector New India Assurance is miles ahead of its peers with a claims settlement ratio of 71 while its closest peer United India has a 554 ratio.

New India Assurance Ipo Review Date Price Drhp Gmp Stockmaniacs

New India Assurance Co.

New india assurance solvency ratio. New India Assurance is a trusted public sector general insurance company that provides healthy and smooth claim settlement process to its policyholders. Largest General Insurance Company - The government intends to create the largest general insurance company in the public sector after the merger of these three public sector companies. The Insurance Regulatory and Development Authority of India or Irdai chairman S C Khuntia on Thursday said the regulator is planning to.

New India Assurance Co reported a 61 rise in profit to Rs 530 crore this quarter compared to the year-ago on the back of higher premium income and. New India Assurance Company was the fourth public sector general insurance company listed in November 2017. State-run New India Assurance registered a 689 per cent drop in its standalone net profit at 8922 crore in the first quarter of the fiscal as against a net profit of 28647 crore in the.

This SFCR covers NIA - UK on a. You can file two types of claims with New India Assurance health insurance policies namely-Cashless and Reimbursement Claims. The solvency ratio of National Insurance is 19.

Post nationalisation it became one of the four subsidiaries of the General Insurance Company of India GIC. To determine the ideal life insurance provider for you you can browse through the solvency ratios of all registered. The New India Assurance Company Ltd.

The other two companies. The New India Assurance Company reported a. The Oriental Insurance Company Limited Oriental Insurance Company Limited was incorporated in 1947 as wholly owned subsidiary of Oriental Government Security Life Assurance Company Limited but now it is owned by the Central Government of India.

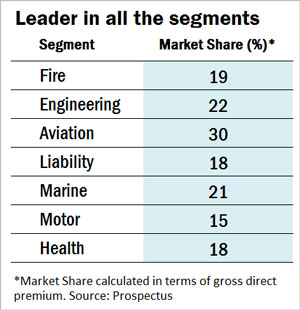

The New India Assurance Company Limited New India Assurance is Indias largest non-life insurance company with the Governent of India GoI holding 8554. The New India Assurance Co. Get New India Assurance Company latest Key Financial Ratios Financial Statements and New India Assurance Company detailed profit and loss accounts.

Annual Report 2019-20 10 NOTICE is hereby given that the 101st Annual General Meeting of the Members of The New India Assurance Company Limited will be convened on Thursday 29th October 2020 at 330 pm through Video Conferencing Other Audio Visual Means to transact the following business. Fundamental Solvency of The New India Assurance Company Ltd for last 10 years including cash Ratio Accruals CFO to DEBT Debt to Assets Interest Coverage Capitalization ratio Long Term Debt To EBITDA debt To capital dividend cover asset to shareholder equity. The cashless claim facility can be availed only at a network hospital.

Health Insurance policies provided by the New India Assurance Co. Ltd NIA - UK stor the Branch as at the year ended 31 March 2018. The biggest life insurance company LIC of India has a claim settlement ratio of 9669 for the year 2019-20.

Are highly sought after because of. Post nationalisation it became one of the four subsidiaries of the General Insurance Company of India GIC. The solvency ratio of New India for.

New India was established in 1919 by Sir Dorabji Tata and nationalised in 1973. This health claim ratio determines the insurers ability to settle your mediclaim requests. The New India Assurance Co Ltd UK Branch SFCR 2017-18 Page 3 Executive Summary This document is the Solvency Financial Condition Report SFCR for UK Branch of The New India Assurance Co.

U 99999 MH 1919 GOI 000526 Form NL-2-B-PL Profit and Loss Account For the Quarter ended 31st Dec 2017. With its incorporation in 1919 it is one of the oldest health insurance companies in India with a vast portfolio of insurance plans to its customers. The incurred claims ratio has shown a considerable improvement from 9281 in H1FY20 to 7569 in H1FY21.

Is a multinational general insurance company headquartered in MumbaiThe company has offices in over 27 countries through different channels. A life insurance company may have a higher percentage of claim settlement by number of policies but a lower percentage when it comes to paying the benefit amount. 530 crore in Q2FY20 a rise of 61 from the previous year.

New India was established in 1919 by Sir Dorabji Tata and nationalised in 1973. The solvency ratio of the company as on the fourth quarter of 2020 stands at 211. The New India Assurance Company Ltd is the largest general insurance company in India in terms of net worth.

NIA command a robust financial position with a solvency ratio as of March 31 2017 and June 30 2017 of 222 and 227 respectively compared to the IRDAI prescribed control level. However even within these limits individual life insurance providers differ in their ranking. Registration No190and Date ofRegistration with the IRDA-01042017 CIN.

New India Assurance Health Insurance Claim Settlement Ratio. As a result life insurance providers in India are expected to maintain a solvency ratio of 15 or a solvency margin of 150. New India Assurance Company the countrys largest non-life insurer reported a net profit of Rs.

The New India Assurance Company Limited New India Assurance is Indias largest non-life insurance company with the Government of India GoI holding 8544.

The New India Assurance India S Premier Multinational General Insurance Company

New India Assurance Has Growth Potential The Sunday Guardian Live

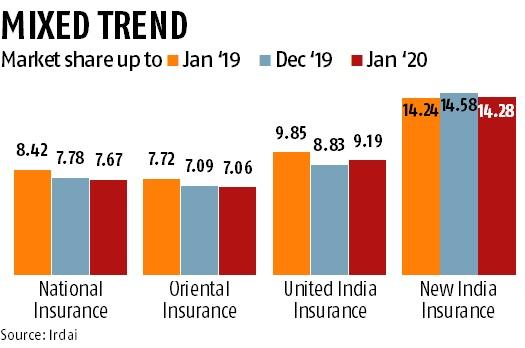

Psu General Insurers Continue To Lose Market Share Merger Plan Stuck Business Standard News

A Financial Health Check Of State Run Insurers To Be Listed

New India Assurance Posts Loss Amid Higher Crop Loans Global Events The Financial Express

The New India Assurance Company Ltd Ipo Details Apply Ipo

New India Assurance Ipo Date Price Gmp Review Details

New India English Pg 2 43 Pmd The New India Assurance Co Ltd

Contents The New India Assurance Co Ltd

Consolidation Of Psu General Insurers May Require Capital Infusion Of Rs 13 000 Crore

New India Assurance Information Analysis Value Research

New India Completes 100 Years Claim Hub

The New India Assurance Company Ipo Review

Solvency And Financial Condition Reports New India Assurance Uk

Merger Of 3 Indian General Insurers Could Boost Sector By Reducing Competition S P Global Market Intelligence

New India Assurance Company Analysis Inside Simple Finance

Posting Komentar untuk "New India Assurance Solvency Ratio"