What's Life Assurance

An assurance on the other hand comes with certain plans or ways for saving as well and a definite benefit at maturity. Alison Free Learning Providing Opportunities To People Anywhere In The World Since 2007.

Read Our Faqs And Info On Life Insurance Moneysupermarket

Life assured or insured is the persons whose life is covered in the insurance contract.

What's life assurance. Noun a type of insurance that pays money to the family of someone who has died. You pay a regular monthly premium for a set period or term at the end of which the policy expires. Alison Free Learning Providing Opportunities To People Anywhere In The World Since 2007.

Once youve thought about a plan its time to decide if a life assurance policy is for you. If you die within the term the policy pays out to your beneficiaries. Life assurance is often sold as whole of life or permanent insurance and comes in many forms.

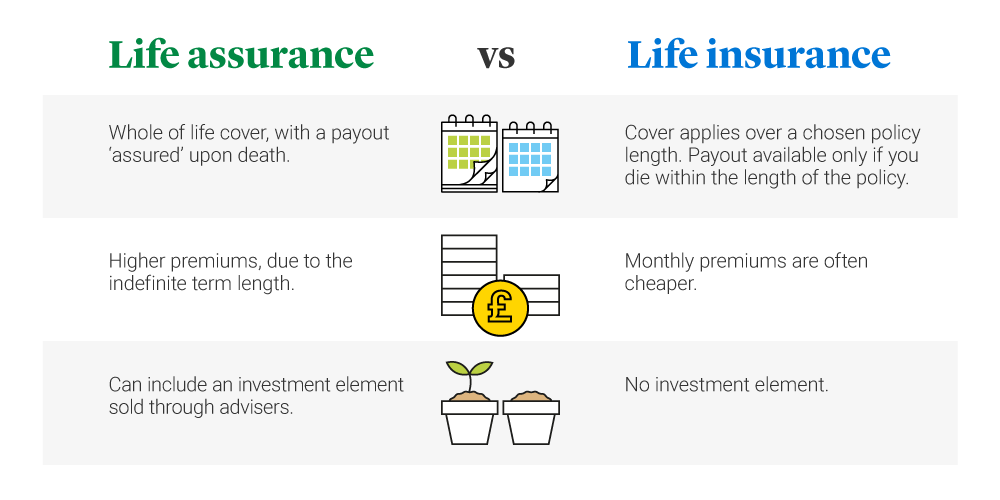

Life assurance vs life insurance. Unfortunately death is one of lifes certainties so a payout is guaranteed meaning that premiums for life assurance policies tend to be higher than for life insurance policies. How Assurance Works.

A life assurance payout is tax-free and provided the premiums have been paid a claim can be made upon the death of the insured person. Non-Standard Life Premium Premium Paying Term Adverse Selection. N a form of insurance providing for the payment of a specified sum to a named beneficiary on the death of the policyholder.

In the UK life assurance is another name. The purpose of life cover is to pay out a tax-free lump sum to your loved ones following your death. Whole-of-life Assurance is a type of life Assurance which ensures that when you die your loved ones will receive a lump sum payout from your insurer.

The most basic type of life insurance is called term life insurance where you choose the amount you want to be insured for and the period for which you want cover. Its worth being aware that over 50s life insurance can sometimes cover life assurance. What is life assurance.

Life Insurance is considerably cheaper than Life Assurance. The term assurance means that youre guaranteed to be paid out upon death and typically whole of life insurance is the main assurance product. Ad His Course Will Give You An In-Depth Look At Life Insurance And Its Different Types.

Essentially the money you pay into the policy will return to you or your family either as a payout should you die or fall ill or a final terminal payment at the end of the term. In the event of a contingency the insured can claim the amount or in the event of the death of the assured the nominee will receive the insurance amount. Life assurance vs life insurance.

Life assurance and life insurance can both provide valuable peace of mind that your loved ones will receive a lump sum in the event of your death. Life assurance explained. Life assurance on the other hand is not based on the principle of protection for a fixed term and instead means you are covered until you die.

Life assurance is a type of life cover that protects you for the duration of your life guaranteeing to provide a pay-out on your death. Because of this it is commonly referred to as whole of life cover. It tends to be more expensive than standard life insurance as it covers you for a longer term.

In other words as long as you keep making the payments life assurance will pay out at whatever age you pass away which is why it is often known as whole-of-life insurance. It is a benefit that many employees now expect to see in their benefits package. Ad His Course Will Give You An In-Depth Look At Life Insurance And Its Different Types.

Life assurance synonyms life assurance pronunciation life assurance translation English dictionary definition of life assurance. As a result this is a more expensive form of life cover. Life assurance is a type of life insurance that runs indefinitely the only reasons a life assurance policy comes to an end are that the policyholder dies or stops paying their monthly premiums.

The key difference between Life Insurance and Life Assurance is Life Assurance is essentially both an investment and an insurance. Term Life Assurance is a cheap form of life insurance that covers you and those assured in the event of death or a critical illness. Furthermore in recent years investment returns on Life Assurance policies have fallen significantly and many insurance companies have placed penalties for cashing in policies early.

If you are looking for a life assurance product please visit our whole of life insurance page. Life Assurance helps provide financial peace of mind for your employees safe in the knowledge that their loved ones may be more financially secure in the event of their death. This has adversely affected the resale value of Life Assurance policies.

Therefore with life assurance typically a payment is made when the policyholder dies. Whole-of-life policies are guaranteed to pay out at some point in the future. However life assurance usually covers the policyholder for their entire life so its also known as whole of life cover.

It does not matter when or where the death occurs. One of the best examples of assurance is whole life insurance as opposed to term life insurance. Typically the period of cover would be about 20 to 30 years and could be taken to cover a mortgage or loan or.

This can be used either to pay off the mortgage or to cover other essential outgoings - or both. Life assurance policies offer insurance cover for the whole of your life rather than a chosen policy length. If you have a.

Therefore are usually life insurance plans eg whole life insurance endowment plans and to a certain degree term insurance although often debatable.

Vul Can Help You Achieve Your Financial Life Goals Learn More Https Mywisefinances Com Life Insurance Facts Life Insurance Quotes Insurance Investments

If You Do Not Know What Life Insurance Is Here Are The Things That It Stands For It Life Insurance Facts Life Insurance Quotes Life Insurance Marketing Ideas

Life Assurance Vs Life Insurance Legal General

Read Our Faqs And Info On Life Insurance Moneysupermarket

Annuity Vs Life Insurance Similar Contracts Different Goals

Most Shocking Life Insurance Facts And Statistics Infographic Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

What Does Life Insurance Stands For Insurancetalk Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Life Insurance Vs Life Assurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Read Our Faqs And Info On Life Insurance Moneysupermarket

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Assignment Of Life Insurance Policy Types Details Rules

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

Understanding The Life Insurance Medical Exam Policygenius

Life Assurance Loading Increase What Can I Do About It Lion Ie

Posting Komentar untuk "What's Life Assurance"