Decreasing Term Assurance Formula

A formula for decreasing term assurance is. Decreasing Term - Mortgage or Business Protection Calculator.

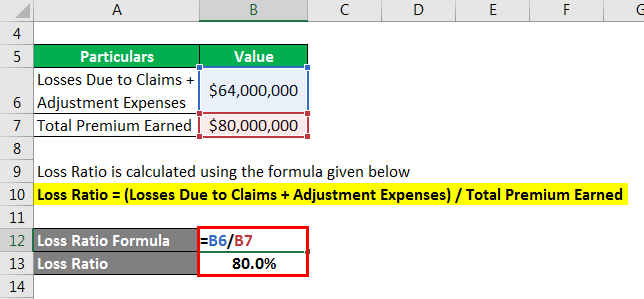

Loss Ratio Formula Calculator Example With Excel Template

Term insurance is any form of life insurance that lasts for a set length of time which is defined at the outset of.

Decreasing term assurance formula. 26 September 2012 at 113PM in Insurance Life Assurance. Active 4 years 10 months ago. Decreasing this means that the value of the final pay-out lowers over time.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Decreasing term assurance How it works and when it is useful. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

It helps you calculate your capitalized value based on current inflation. From 21 the present value of the annuity is 100a5e 100. Terms and interpretation 2 2.

The most obvious example is if youre repaying a mortgage. With a decreasing term policy you will choose a length of time for the policy to run so it will have a start and an. Terminal and critical illness riders.

Both policies come with term lengths which can go up to 30 years and they both charge constant premiums over time. Our Decreasing Cover pays out a single amount that reduces over the term of the policy. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No.

Ive acquired a few quotes for life insurance that look promising. A very simple term contract designed to. Im minded to go for a decreasing cover policy because the primary purpose of the payout if I die will be to pay off the mortgage.

V_0 V_k times leftfrac1-1r-n1-1r-n-k. You pay for the cost of the insurance either annually or. It offers a choice in terms of level term assurance and decreasing term assurance for loan protection of family income protection.

Simply enter the initial sum assured plan term. Decreasing term assurance policy terms and conditions contents 1. Decreasing term assurance - find the interest rate.

Term means it has a fixed number of years to run and eventually expires. Guaranteed cover 2 4. Term this means the length of time.

Death benefit exclusions 3 9. A decreasing term assurance policy sees the amount to be paid out sum assured decreasing over the term of the policy. Decreasing term is a type of term life insurance which provides affordable and flexible coverage for a set period of time.

Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. A decreasing term insurance plan is a term plan where the Sum Assured decreases every year by a fixed percentage.

You can choose the original Sum Assured under the plan which. Now the most favourable quote for 130000 over a 12 year term comes with the. This method calculates sum assured based on your current and future expenses present and future earnings and age.

Although payments stay the same over the term of the policy how much you pay each month is typically less than for level term life insurance. Not necessarily suitable for the decreasing temporary assurance. Most decreasing term life insurance policies come with or allow you to addon terminal and critical illness ridersA terminal illness rider is usually included at no additional cost and allows you to access your policys death benefit while still alive if you need the funds to cover expenses such as hospice care the hiring of a caretaker or residence at a.

Other features of the plan are similar to normal term insurance plans and are as follows. You can now find Human Life Value calculators online to know your HLV and select the right sum assured. What might begin as 300000 cover might only be 200000 after eight years and 100000 after sixteen.

In the event that the policyholder dies the insurance payout would be sufficient to clear the. Decreasing Term Insurance Formula. An insurance policy that decreases.

This calculator can help you to see how much your clients could receive in the event of a claim. Decreasing refers to the pay-out reducing over time. Also calculate its future value at time 5.

Ask Question Asked 4 years 10 months ago. In terms of a standard term policy or a level term life insurance the face value of 850000 would remain constant over the policys life. Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage.

This formula was best suited for use for equal decrements of sum assured. Reasons to Consider or Purchase Decreasing Term Insurance. Life assurance is a type of life insurance that runs indefinitely the only reasons a life assurance policy comes to an end are that the policyholder dies or stops paying their monthly premiums.

Decreasing term life insurance is aimed at people whose financial commitments reduce over time. Remember if you have an interest only mortgage you will require a different type of life. Youll take out a decreasing life policy for a fixed period of time called the term.

As the amount you need to pay on your mortgage also decreases this is the policy that is usually used to provide this kind of cover. Guaranteed premium 2 3. Terminal illness accelerator 3 10.

A decreasing term assurance policy is usually the same as a mortgage term assurance policy. Asbury 6 described this method but using net premiums 3 A rather lighter task by the use of a formula of the form where R is the level annual repayment for the term n at the mortgage rate of interest j. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

With term insurance if you die while the policy is active your family receives a cash payout from your insurance company to use however they like. Policy period of cover 2 6premiums 3 7death benefit 3 8. Decreasing sum assured 2 5.

Viewed 68 times 2. We offer four interest rates for mortgage or business decreasing term to help make matching your client needs easier - 5 7 8 and 10. Assurance shows that it is an insurance product.

In other words as long as you keep making the payments life assurance will pay out at whatever age you pass away which is why it is often known as whole-of-life insurance.

Decreasing Life Insurance Life Cover Legal General

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better

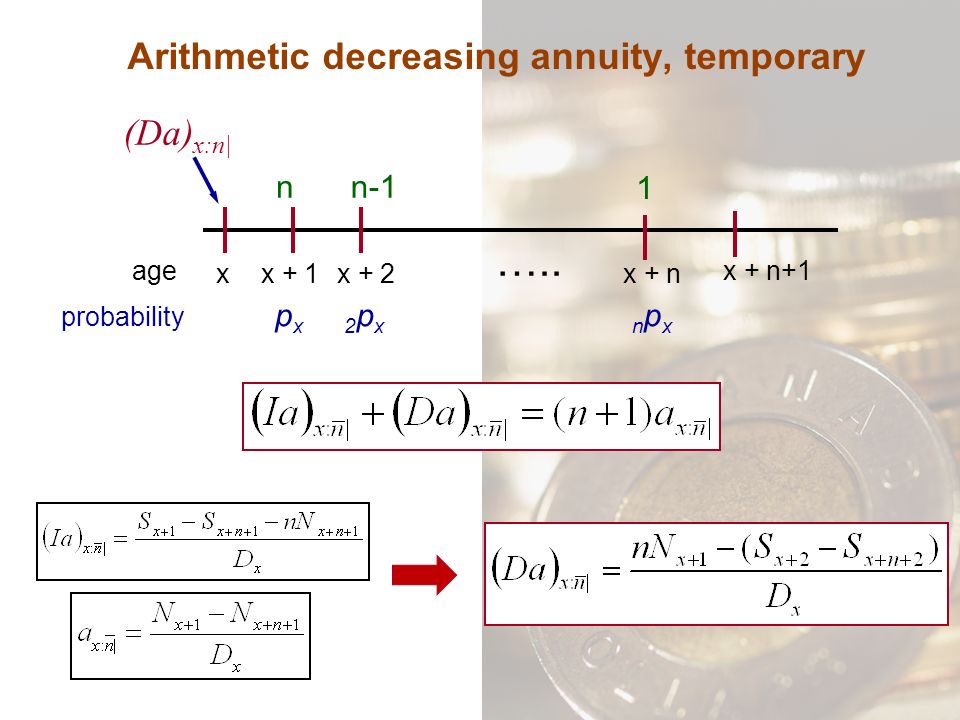

Chapter 8 Life Annuities Ppt Video Online Download

Calculation Of Gap Score And Unweighted Average Servqual Score Download Scientific Diagram

Loss Ratio Formula Calculator Example With Excel Template

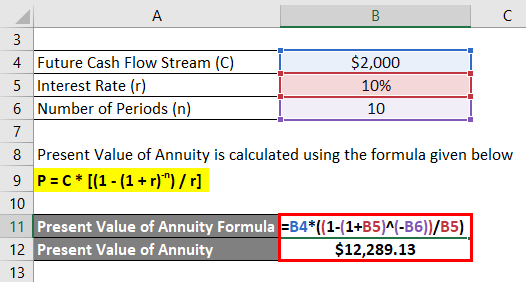

Annuity Formula Calculation Examples With Excel Template

Decreasing Term Life Insurance Comparethemarket Com

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better

Formulas And Definitions Of Frequency Terms Commonly Used At Different Download Scientific Diagram

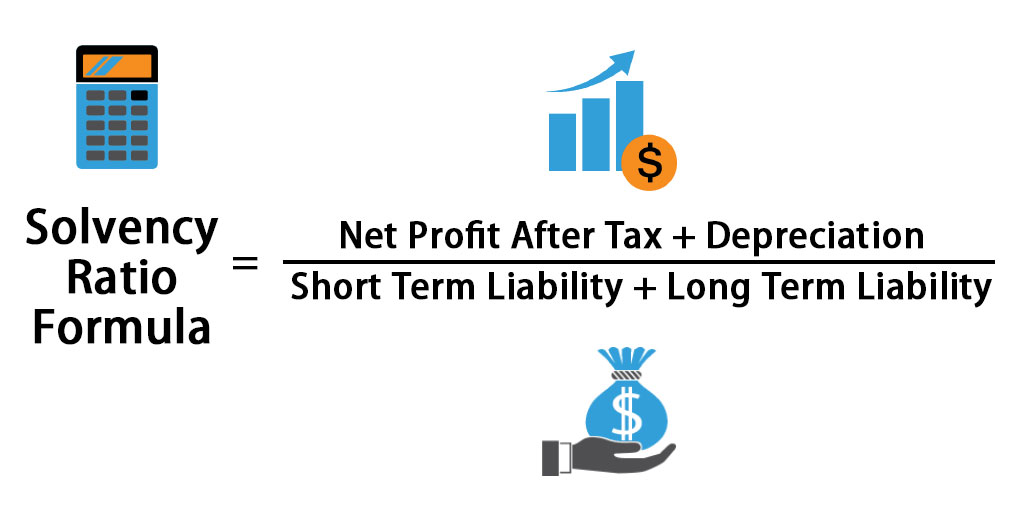

Solvency Ratio Formula Calculator Excel Template

Decreasing Life Insurance Life Cover Legal General

Pdf Formula Sheet For Actuarial Mathematics Exam Mlc Asm 2014 Monica Revadulla Academia Edu

Annuity Formula Calculation Examples With Excel Template

Pdf List Of Formulas For Actuarial Mathematics Courses Monica Revadulla Academia Edu

Formulas And Definitions Of Frequency Terms Commonly Used At Different Download Scientific Diagram

Posting Komentar untuk "Decreasing Term Assurance Formula"