What Is The Meaning Of Sum Assured In Insurance Policy

Sum insured is the maximum value for a year that your Insurance Company can pay in case you are hospitalized. My dear SA in Insurance team Amount which has to given by LIC OF INDIA to its clints on Maturity eg if one takes LIC of India policy Jeevan Anand for SA 5000 Lacks terms 2100tearm he she ii get on Maturity after 2100 years get SA Rs 5000Lacks bonus and versted bonus also.

Sum Assured Meaning In A Guaranteed Savings Plan

The sum insured correlates directly to the amount of premium you pay but not always to the propertys actual value or.

What is the meaning of sum assured in insurance policy. Sum assured is a pre-decided sum that is given to the policyholder in case the insured event occurs. Sum insured is the value applicable to non-life insurance policies like car insurance. How is the Sum assured Calculated.

It will cover the loss arising out of the damage caused to you. Sum assured is the amount that your beneficiary will get if you die during the policy term. This is a predetermined amount that is mentioned in the insurance policy during the purchase.

It basically is based on the principle of indemnity that provides a reimbursement compensation to damageloss. So if you pay an annual premium of INR 10 000 the sum assured would become INR 1 lakh. In property insurance like fire insurance the insure is also the assured where the proceeds are payable to him.

Meaning pronunciation translations and examples. The sum assured depends upon the income of the person and typically a maximum of up to 10 times the annual income is allowed as the sum assured. Sum assured is the fixed amount that an insurance company guarantees to a policyholder or their legal heirs on occurence of the insured event in return for receiving premiums under a life.

The sum assured is the guaranteed amount that the beneficiary of your life insurance policy will receive in case of your death. Sum assured is the value of life cover defined under life insurance policies. The sum assured is the amount of money an insurance policy guarantees to pay up before any bonuses are added.

A term rider is a term insurance policy that pays the sum assured on death of the policyholder. Though a novice might interpret the sum assured and sum insured to mean the same their actual meanings are significantly different. In any case of any eventuality like death the sum assured is the amount that is paid to the beneficiary.

A person protected by insurance coverage against loss or damage stipulated by the provisions of a policy purchased from an insurance company or an. Answer 1 of 3. In a term insurance policy the nominees receive a fixed amount as the sum assured in case of the policyholders death.

This is mostly applicable to life insurance. Lets see an example of sum assured in health insurance. For instance if you buy a life insurance policy the insurance company guarantees to pay a fixed sum to your nominee in case of your death.

Concept of Sum Insured Vs Sum Assured. This figure is the guaranteed amount of money that your loved ones will receive in your absence provided all. Importance of Appropriate Sum Insured It provides you a sense of security in terms that even if something happens to you today your lifelong savings will not get exhausted over treatment and you will be left with some money to go through your later.

In other words sum assured is the guaranteed amount the policyholder will receive. Sum assured is a fixed amount that is decided between the policyholder and the insurance company. Sum insured and sum assured are among the fundamental terms that an individual essentially needs to understand before choosing a life insurance planThe two terms are the basis on which a plan is evaluated.

Assured is also used sometimes as a synonym of beneficiary. What Does Sum Insured Mean. Thus the sum assured and premium of a life insurance policy are interconnected.

For example if a person is guaranteed. The sum assured is the amount payable on the occurrence of an event insured against under. What is sum assured in health insurance.

Usually the multiple is expressed as 10 times the premium paid. Meaning compensation received for. Dinkar is a 50-year-old person with a family history of cancer.

Sum assured is the value of the insurance cover provided at the time of buying the insurance policy. Sum assured is the clause generally seen in life insurance policies while sum insured is majorly seen in policies other than life insurance. The sum assured is also known as the coverage or the cover of your insurance policy.

The insurer will pay the entire amount if an insured medical event takes place. In this article we discuss its meaning in insurance and how to calculate it. Sum insured is the value applied to Non-life insurance.

The insurance company pays this money as per the sum chosen by you at the time of purchasing the policy. Now that you know how to calculate the payout on a ULIP you can make an informed decision before buying one. Sum insured is the amount of money that an insurance company is obligated to cover in the event of a covered loss.

There are many different ways to calculate the sum assured for your life insurance policy. Your Sum Assured is usually calculated by taking into account the economic value of your life Human Life Value which may actually go up in time for a person. Therefore choosing a sum assured is very important because through insurance you create a financial cushion for your family.

A sum assured is a fixed amount that is paid to the nominee of the plan in the unfortunate event of the policyholders demise. Sum assured definition. Sum assured in insurance is the sum of money that you receive at the end of your insurance tenure.

In ULIPs case the final amount can comprise the sum assured the fund value or both. Keep in mind that since most of these riders are defined-benefit plans the benefits are fixed. This sum payable to the nominee on the happening of the insured event is known as sum assured.

Sum assured is an amount of money which they entitle a beneficiary to at the death of the benefactor. The sum assured in such plans is expressed as a multiple of the premium amount. The wife is the owner of the policy but she is not the insured.

Sum assured is the value applied to Life insurance policies. This term is commonly associated with homeowners or property insurance but can also apply to other types of insurance. The wife is the assured and the husband the insured.

This works on the principle of indemnity. Any amount above and beyond the sum insured will have to be taken out from your own pocket. It remains the same in the beginning and end of the insurance tenure.

It is that fixed amount that the insurer pays the policyholder in case of an eventuality.

What Is The Meaning Of Sum Assured In An Lic Policy Quora

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

Do You Ve A Lump On Your Neck Back Or Behind Your Ear This Is What It Means Buy Life Insurance Online Life Insurance Policy Life Insurance Calculator

A Look At Premium Rates For Some Insurance Policies Of A Sum Assured Of 1 Crore Across Three Age Categories For Policy Terms How To Plan Term Insurance Policy

Mahalaxmi Double How To Plan Business Insurance Best Insurance

Term Insurance Plans Protects Your Family And Loved One S Against Any Threat Under On Term Life Insurance Quotes Life Insurance Quotes Life Insurance Companies

Online Premium Payment Of Mahalaxmilife Insurance Life Insurance Business Insurance Insurance Premium

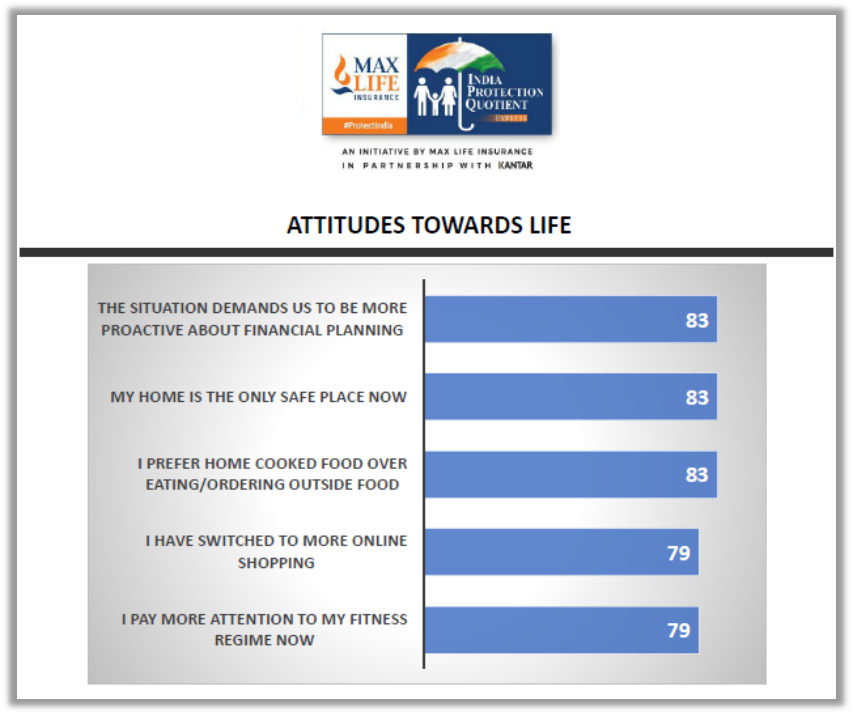

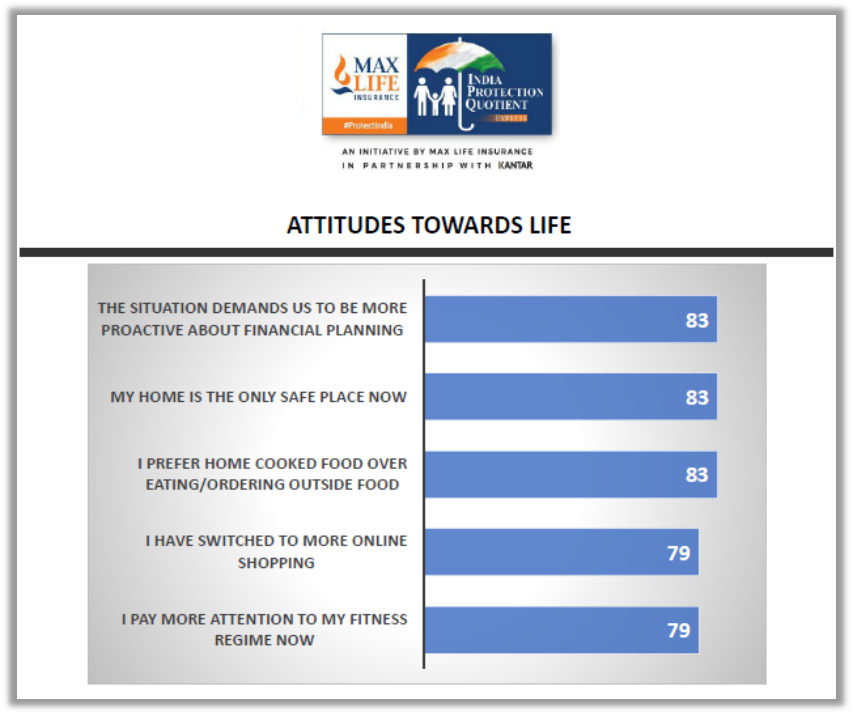

What Is Sum Assured Max Life Insurance

What Is Sum Assured Max Life Insurance

Health Insurance Plays A Pivotal Role In Saving And Planning For Health Related Emergencies Here Are The F Insurance Quotes Quotes Website Compare Insurance

Sum Insured In Health Insurance Compare Sum Assured Vs Sum Insured

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

Lic S Jeevan Lakshya Life Insurance Quotes Life Insurance Marketing Life Insurance Marketing Ideas

Sum Assured Meaning What Is Sum Assured In Insurance Icici Prulife

What Is Term Insurance Everything You Need To Know Term Insurance Life Insurance Policy Life Insurance Companies

Bajaj Allianz Savings Asssure Is A Traditional Endowment Plan That Not Only Secures You And Your Family But Also G How To Plan Investing Savings And Investment

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Insurance Calculator Life Insurance For Seniors Term Insurance

What Is Sum Assured Max Life Insurance

What Is The Meaning Of Sum Assured In An Lic Policy Quora

Posting Komentar untuk "What Is The Meaning Of Sum Assured In Insurance Policy"